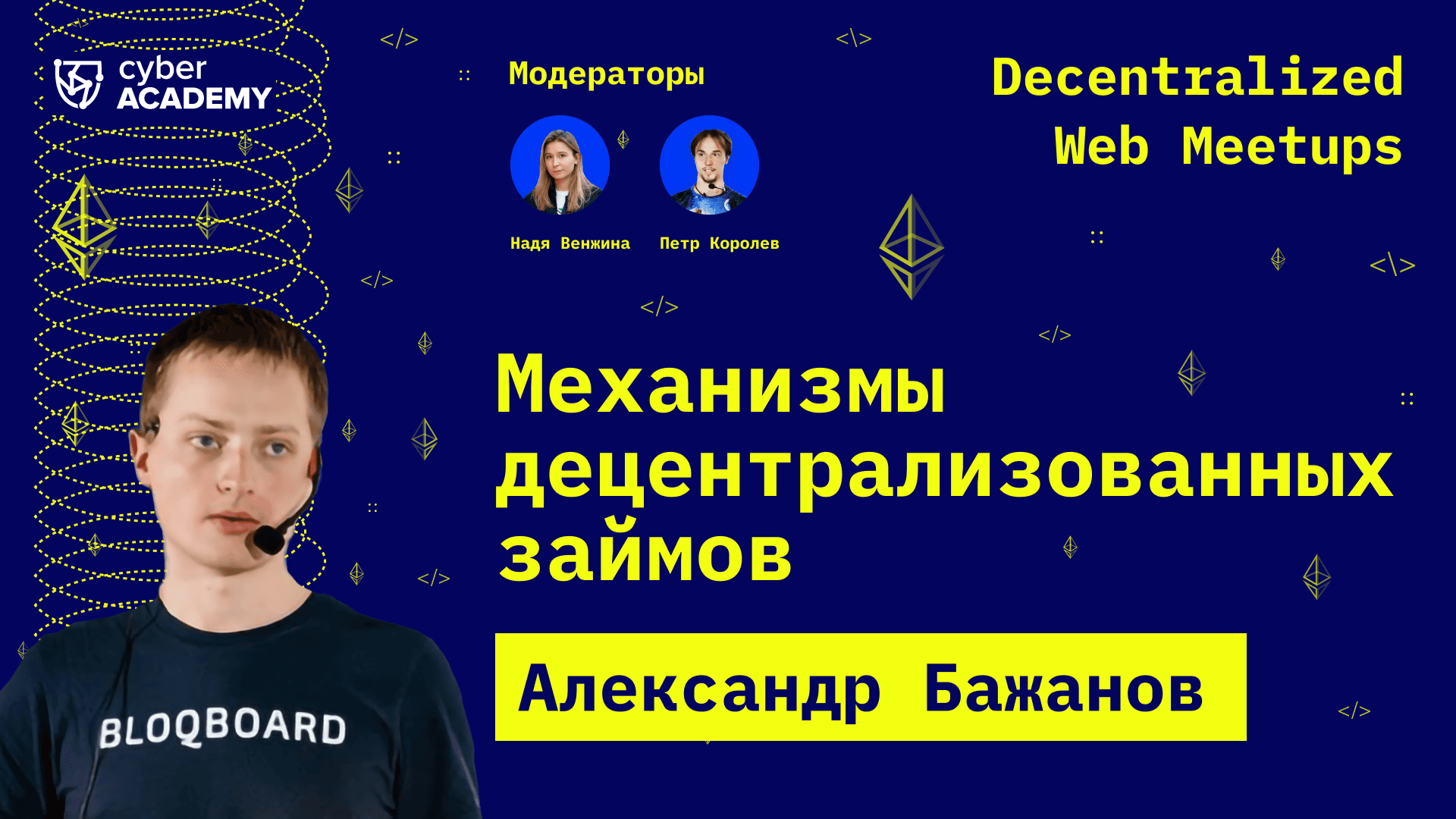

Decentralized Lending Mechanisms

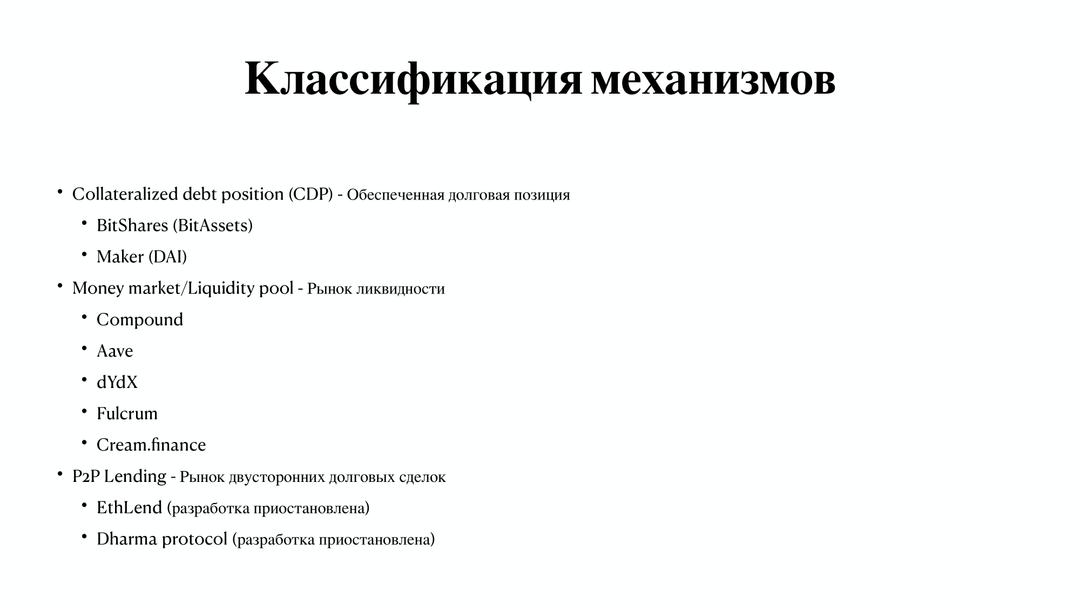

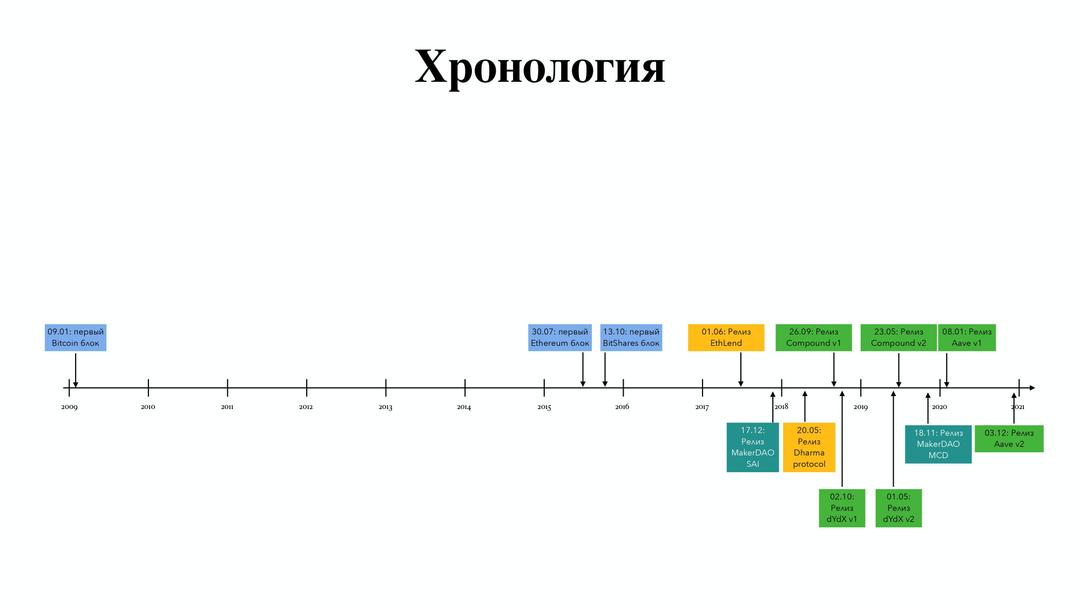

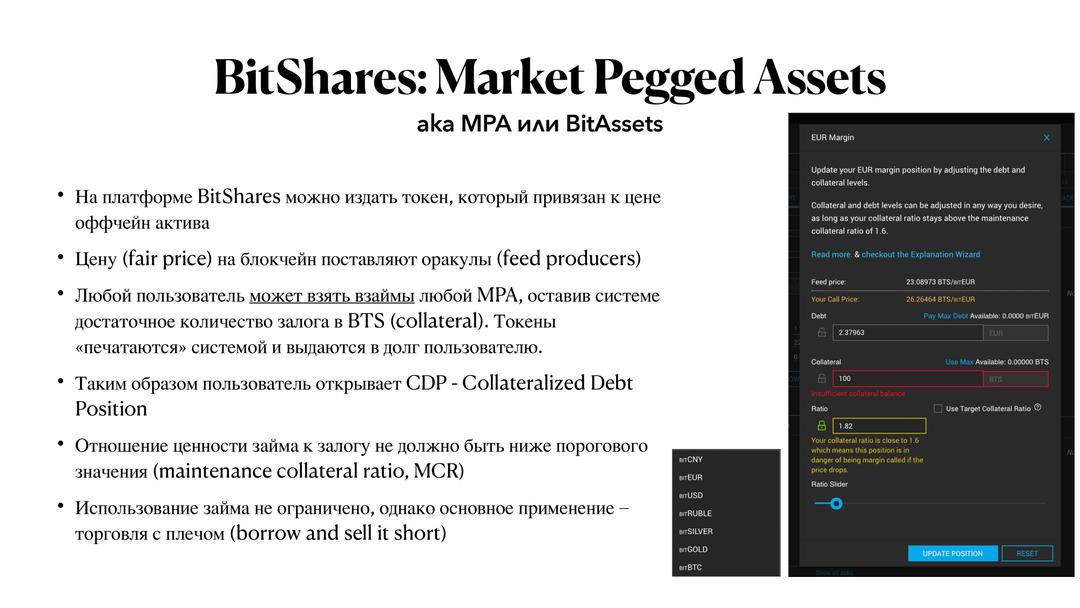

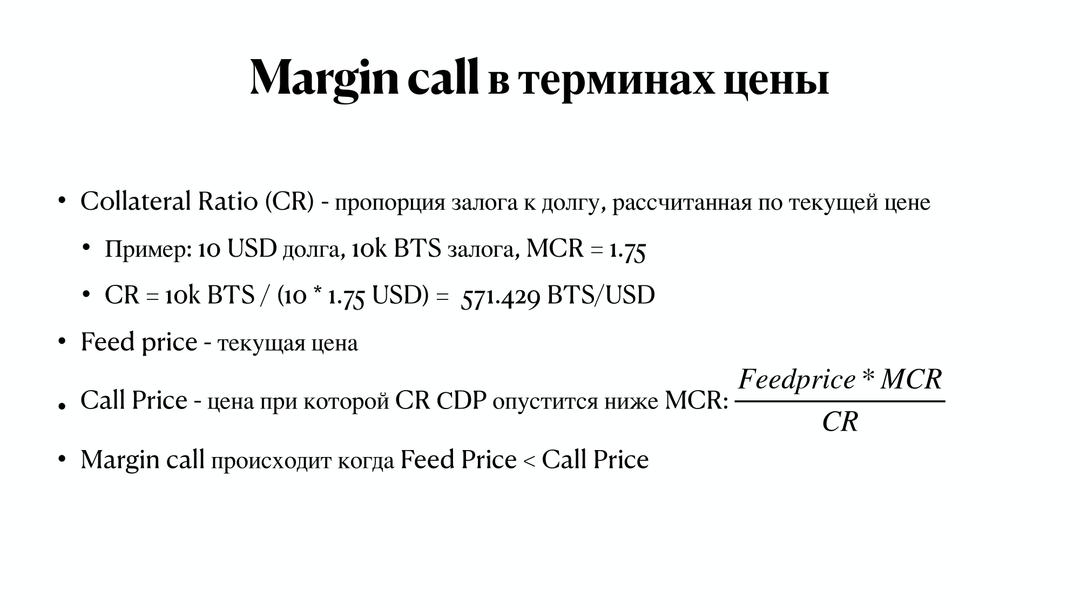

Decentralized loans are one of the most in-demand primitives in DeFi. If you open defipulse.com, you'll notice that four out of the top five DeFi protocols by Total Value Locked (TVL) are lending protocols: Aave, Maker, Compound, and InstaDapp. Yet, few realize that the predecessor of all these applications was BitShares, a DPoS blockchain launched by Dan Larimer back in 2015. Many core DeFi elements such as loans, liquidity pools, margin trading, and synthetic asset issuance first emerged precisely on BitShares. However, today, the project is barely maintained and has a very small community.

In this video, we will dive into popular protocols (MakerDAO, Compound, Aave, dYdX), exploring their principles, key differences, liquidation mechanisms, and discussing the risks and future prospects of decentralized finance.

- 🔹 How decentralized lending mechanisms work

- 🔹 Comparison of MakerDAO, Compound, Aave, and dYdX protocols

- 🔹 Practical insights into asset liquidation

- 🔹 Flash loans and credit delegation in DeFi

- 🔹 Major risks and challenges in decentralized lending

- 🔹 DeFi use cases for earning and efficient capital management

Slides: Decentralized Lending Mechanisms: A History of Ideas and Protocols.